The Energy Edge: U.S. Gas Producers Up to Challenge

Today's Takeaway: Mexico-U.S. Relationship Proving U.S. Gas Producers Up to Challenge

As the Trump administration has pushed for increased natural gas exports to Europe, some have questioned if U.S. production could match the demands. But the oil and natural gas industry has quietly proven that it's capable of getting the job done as it continues to increase exports to Mexico – with more on the way as the industry seeks to debottleneck the burgeoning Permian basin.

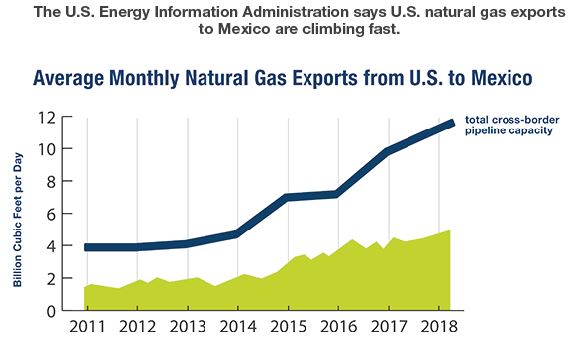

The U.S. Energy Information Administration says U.S. natural gas exports to Mexico are climbing fast.

What's the Point?

U.S. natural gas is rapidly flowing across the Rio Grande at a rate never seen before thanks to stable domestic production and the commissioning of multiple key pipelines in Mexico.

From 2008 to 2014, exports of natural gas to Mexico grew modestly to about two billion cubic feet per day. But since 2016, this growth has picked up dramatically. In July, natural gas exports to Mexico via pipeline surpassed 5 billion cubic feet per day for the first time in history[1], and just last month, The U.S. Energy

Department announced that four additional pipelines are slated to begin commercial operations by year's end to deliver natural gas from West Texas to Mexico.[2]

What's facilitating this massive growth is clear. The boom in horizontal drilling and hydraulic fracturing has made extracting natural gas easier, more predictable and less expensive.

Why Should I Care?

Mexico has long been the leading purchaser of U.S. natural gas. Still, the uptick in exports to our neighbors to the south over the last few years has been significant. The positive impacts of this increase should help to settle any lingering international debates about the ability of the U.S. to become a leading international exporter.

The increase in exports has not upended energy markets. It hasn't had negative domestic or international economic effects. And it hasn't negatively impacted trade, as the recently announced new trade deal with Mexico demonstrates. The increase in exports has led to a boom in available jobs in the Permian basin that producers can't fill fast enough.

But it doesn't end in the Permian, moving more gas to market from the Permian has the ability to help producers across the U.S.

There will always be naysayers, but the industry has quietly demonstrated its ability to make international exports work.

For more cutting-edge perspectives on the most compelling news, facts and figures impacting the U.S. energy industry, read other editions of The Energy Edge.