The Energy Edge: The U.S. Can't Afford to Sit Idle Any Longer

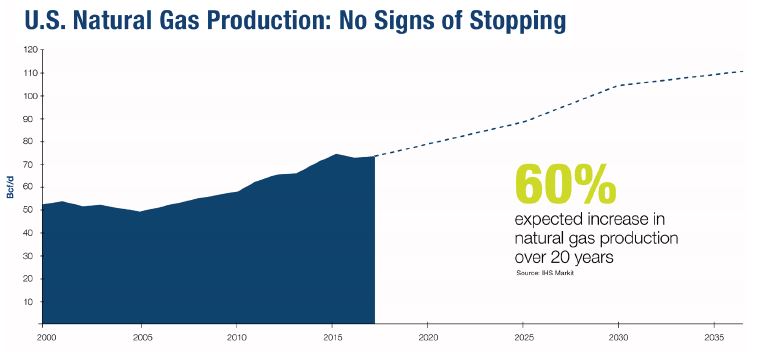

What's Happening? IHS Markit says U.S. natural gas production is expected to rise by 60 percent over the next 20 years.

What’s the Point?

The Boom Continues:

Everyone knows horizontal drilling and hydraulic fracturing have forever changed the energy landscape, but few truly expected the staggering growth we’ve seen since it became widespread.

From 2000-07, total natural gas production in the U.S. grew by less than 1 percent. But over the next 10 years, as technology improved and more players entered the game, output soared to a whopping 40 percent. Now, it shows no signs of slowing down.

Recent improvements in infrastructure and pipeline construction have already positioned the U.S. to join Australia and Qatar as one of the three largest exporters of LNG in the world. Together, they’re expected to export nearly 60 percent of the world’s supply by 2025.1

And if the IHS Markit estimate comes true? Let’s just say the full potential of natural gas is yet to come.

Why Should I Care?

Other countries have the pedal to the floor on energy production, while the U.S., and particularly the Marcellus Shale region, is relatively stuck in neutral.

Despite pipeline construction undertaken over the last decade, infrastructure to transport LNG across the continental U.S. is seriously lacking. Even Boston, a city just a few hundred miles from the edges of the Marcellus Shale, is forced to import its LNG from overseas because there is no existing pipeline infrastructure to get domestic natural gas there. At this point, that’s almost unacceptable.

Combine it with the absence of an underground storage facility in the Appalachian region, and it becomes even harder for states like Ohio, Pennsylvania and West Virginia to take advantage of their abundant resources. These states want to use natural gas liquids as raw materials for more locally based manufacturing facilities but can’t because the region’s infrastructure is still so far behind. Until that changes, producers will face greater cost uncertainty and transportation risk.

We are on the precipice of seeing the U.S. become not just a world leader in energy but the world leader. Yet, in order for IHS Markit’s 60 percent expected growth to mean anything, even more significant investments must be made in affecting policy, increasing pipeline construction and shifting public opinion on the safety and economic benefits of natural gas. The U.S. can’t afford to sit idle any longer.

For more cutting-edge perspectives on the most compelling news, facts and figures impacting the U.S. energy industry, read other editions of The Energy Edge.